Stock market investment budget for people with limited incomes

Do you want to invest in stock market You don’t have much money to invest.

don’t worry you are not alone There are many people whose income is low but they want to

invest in the stock market.In today’s article you will see how stock market investment budget for people with limited incomes

Dividend Reinvestment Plans (DRIPS)

Compounding returns are a powerful way for an investor to exponentially grow a portfolio over time.

Investors can achieve compound returns from stocks, ETFs, and mutual funds by reinvesting dividends earned from owning those investments.

Many, but not all, companies issue cash. dividends to shareholders, typically on a quarterly basis.

These dividends are a way to share profits. with investors. A dividend reinvestment plan, or DRIP, allows you to automatically reinvest dividends to purchase additional shares. Of course, you could buy additional shares. any time. But because DRIPs are automatic, they can reduce complicated decision-making and allow Imagine 100 shares of a company that is currently trading at $100 per share.

This company pays out an annual 4% dividend. would now be worth $18,000. But for the investor who reinvested dividends, Her initial investment would be worth more than $22,000—that’s a 50% higher rate of return than the investor who kept the cash. dividends. And this example doesn’t even include potential. gains from the stock’s price appreciation. Of course, investors always want to buy more shares at a lower price.

Exchange-Traded Funds (ETFs)

Exchange-traded funds (ETFs) are funds that are traded in the stock market.

ETFs are a different type of fund whose price keeps changing every second, or we can buy or sell them easily like stocks. What are the types of ETFs, like stocks? ETFs: gold, ETF commodities ETFs bond ETFs real state ETFs

If we do not want to invest directly in the stock market, exchange-traded funds (ETFs) are the best option to invest indirectly.

Direct Stock Purchase Plans (DSPPs)

DSPP, a direct stock purchase plan, or DSPP lets you buy a company’s stock. directly from the company itself, without needing a broker, some companies offer these plans directly to retail investors.

While others use third-party admin While others use third-party Administrators DSPPs usually have low fees, and may even allow you to buy shares at a discount. These plans can be great for first-time investors who don’t have a lot of money to start.

With a DSP, you can set up an account and make monthly deposits to buy shares directly from the company each month, the plan uses your deposits to purchase new shares or fractions of shares, which makes it easy to slowly build up shares in a company without Needing a lot of money upfront,

these Plans often have very low fees or no fees. fees at all, making them a budget-friendly way to start investing

Companies offering DPPs can bring in new investors who might not have been able to invest; otherwise, it can also help companies raise funds at a lower Cost companies usually provide information

It used to be a great option when Online investing was more expensive, but with investing platforms becoming cheaper, some of the original benefits of DSPPs have faded; for example, advantage of not needing physical stock Certificates are no longer a big deal.

that most stocks are kept electronically, while DPPs are still appealing in theory, they’re not as practical, as they used to be When you use a DSP, you won’t have control over the trade date and the transaction may not happen for weeks.

This means you won’t know the exact stock price at the time of purchase on on the other hand, using discount brokers allows you to trade in real time and know the price at all .good option for small investors

who want to buy shares of a company and hold them as long-term DSSPs allow you to slowly and automatically Build up your position in a company. without a large upfront Ratio DPPs usually have low fees, and may even allow you to buy shares at a discount.

These plans can be great for first-time investors who don’t have a lot of money to start. With a DSPPs, you can set up an account and make monthly deposits to buy shares directly from the company each month.

the plan uses your deposits to purchase new shares or fractions of shares, this makes it easy to slowly build up shares in a company without Needing a lot of money up front.

these Plans often have very low fees or no fees fees at all, making them a budget-friendly way to start investing Companies offering DPPs can bring in new investors who might not have been able to invest; otherwise,

it can also help companies raise funds at a lower Cost companies usually provide information It used to be a great option when Online investing was more expensive, but with investing platforms becoming cheaper, some of the original benefits of DSPPs have faded; for example ,advantage of not needing physical stock Certificates are no longer a big deal.

that most stocks are kept electronically, while DSPPs are still appealing in theory, they’re not as practical, as they used to be

When you use a DSP, you won’t have control over the trade date and the transaction may not happen for weeks.

This means you won’t know the exact stock price at the time of purchase on the other hand, using discount brokers allows you to trade in real time and know the price at all. good option for

small investors who want to buy shares of a company and hold them as long-term DPs allow you to slowly and automatically Build up your position in a company without a large upfront

The 401(k)

why they’re a great option for retirement savings. But first, let’s start with the basics.

What is a 401K plan?

A 401K plan is offered by many employers. It allows you to save a portion of your pretax income for retirement, and your employer may also contribute to your account.

When you contribute to your 401k, you’re able to reduce your taxable income, which can help you save on taxis.

taxis, plus the money in your 401k grows tax-free until you withdraw it in retirement.

Now, let’s talk about the principle of 401K plans specifically.

Principle is a well-known financial services company that offers a variety of retirement planning options, including 401K plans.

One of the great things about principal 401K plans is that they offer investment options. So you can choose the funds.

that is best for your individual situation.

Online tools and resources make it easy to manage your account and stay on top. of your retirement savings goals, Whether you’re just starting your career, or you’re nearing retirement age.

A principal 401K plan can help you achieve your retirement goals.

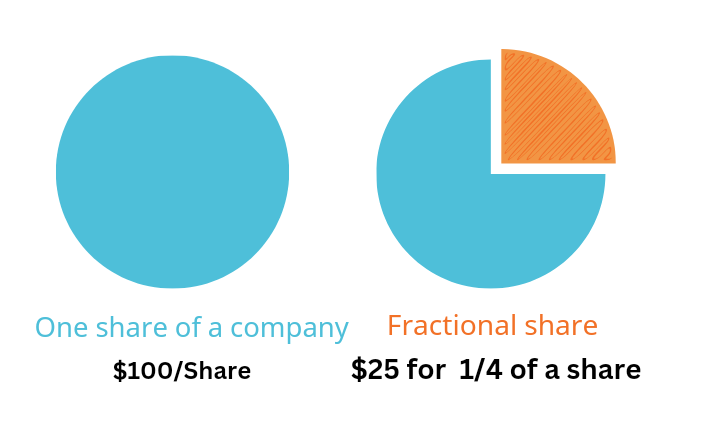

Fractional Shares

A fractional share is when you own less than one full share of a stock or other security. It’s a way to invest even when you don’t have enough money to buy the whole share, like buying a slice of pizza instead of a whole pie.

Can low-income people invest?

Yes, anyone with a low income can invest. Many people think that it takes a lot of money to invest. To invest, you need a small budget, not a big budget. You can also start with a small amount to invest; for this, you will have to make a budget and start small.

Then, after that, you can invest now. While investing, you also have to have an investment goal. To have discipline is to keep investing with consistency.

How can I be successful with a low income?

want to be successful, you have to follow some points.

So let me give you some points. First of all, you have to improve your financial education, and then you have to invest money. And you will have to save money and start investing as soon as possible at an early age. You have to start with a small amount and make a budget. Then you will have to invest in this stock market. Then you can get help from any financial advisor for investing. If you follow these things, then no one can stop you from being successful.

FAQs

What is the safest investment of all time?

in 2024 safest investment of all time is government bonds

Do I pay taxes on stocks I hold?

yes the gain from these investments will be taxed at a long-term capital gains tax rate of 20%

Can you make a living off of stocks?

Yes, you can earn money from stocks and also you can grow money in stock market